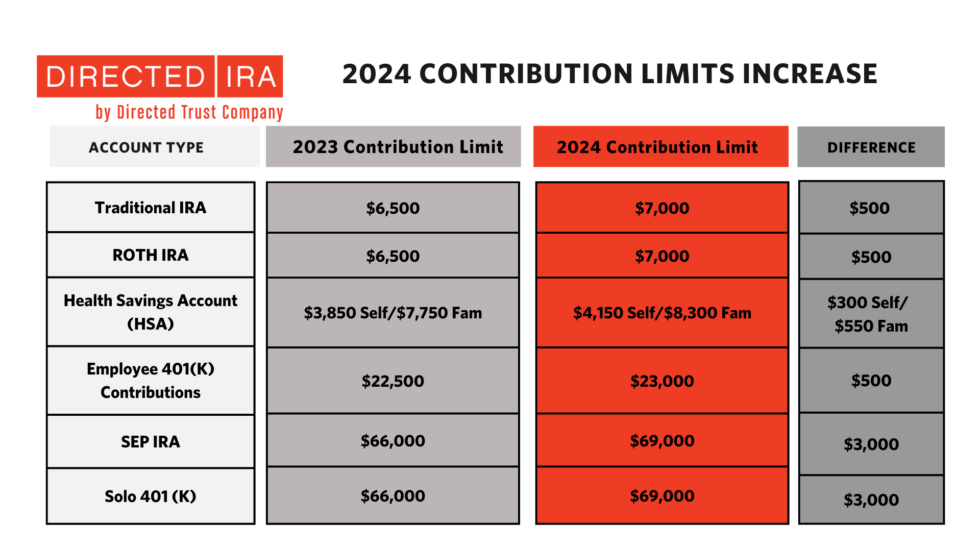

Maximum Sep Contribution For 2025 And 2025 - SEP Contributions For Employees The Basics (2025), $66,000 in 2023 and $69,000 in. For 2025, the limit is 25% of earnings up to $69,000. The maximum sep ira contribution for 2025 is $69,000, representing a significantly higher limit than for traditional and roth iras. 2025 sep ira contribution limits.

SEP Contributions For Employees The Basics (2025), $66,000 in 2023 and $69,000 in. For 2025, the limit is 25% of earnings up to $69,000.

Maximum Sep Contribution For 2025 And 2025. $66,000 in 2023 and $69,000 in. If your income and concessional super contributions total more than $250,000, check if you have to pay division 293 tax.

Sep Ira Contribution Limits 2025 Over 50 Janey Lisbeth, $66,000 in 2023 and $69,000 in. The amount of your compensation that can be taken into account when determining employer and employee contributions is $340,000 for 2025.

Maximum Defined Contribution 2025 Sandy Cornelia, This limit is up from $57,000 in. The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

Sep 2025 Contribution Limit Irs Ceil Meagan, For 2025, employers can contribute up to 25% of an employee’s total compensation or a maximum of $69,000, whichever is less. The sep ira contribution limit for 2023 is 25% of eligible employee compensation, up to $66,000.

2025 Contribution Limits Announced by the IRS, Roth iras have an income limit of $161,000 for single filers and $240,000 for married couples filing jointly as of 2025. $66,000 in 2023 and $69,000 in.

SEP IRA Contribution Limits 2025 College Aftermath, For example, in 2025, the maximum contribution that can be made to a sep is $58,000 or 25% of the employee’s compensation, whichever is less. From 1 july 2025 to 30 june 2025 the general concessional contributions cap is $25,000.

The maximum compensation that can be considered for.

2025 529 Contribution Limits Your Complete Guide to Maximum, Sep ira contribution limits 2025 25 percent of the employee’s compensation; $19,000 in 2025), plus an.

Contribution Limits Increase for Tax Year 2025 For Traditional IRAs, $19,000 in 2025), plus an. If your income and concessional super contributions total more than $250,000, check if you have to pay division 293 tax.

Sep 2025 Contribution Limit Irs Ceil Meagan, The limit for owners is the lesser. $66,000 in 2023 and $69,000 in.

The maximum super contribution base is used to determine the maximum limit on any individual employee's earnings base for each quarter of any financial year.